Introduction: Why Technology Isn’t the Real ESG Problem

For the first time, ESG reporting isn’t struggling because of technology. Most organisations today have access to powerful sustainability platforms, automated ERP integrations, IoT devices capturing real-time resource usage, OCR tools extracting data from invoices, and AI systems capable of cleaning and standardising ESG inputs. In other words: the tech is ready, mature, and more capable than ever.

And yet, ESG reports continue to be delayed, inconsistent, and riddled with missing or unverifiable data. Automation is in place. Tools exist. Data pipelines are technically feasible.

So why does ESG reporting still feel like a scramble every single year?

Because the real bottleneck isn’t technological, it’s behavioural. The obstacles live in culture, habits, ownership, incentives, and day-to-day decision-making. Not in code.

Behind every dataset is a human decision: to record it, to verify it, to disclose it or not to.

Until organisations deal with the behavioural and cultural frictions of ESG data, even the best technology in the world will struggle to deliver clean, credible sustainability insights.

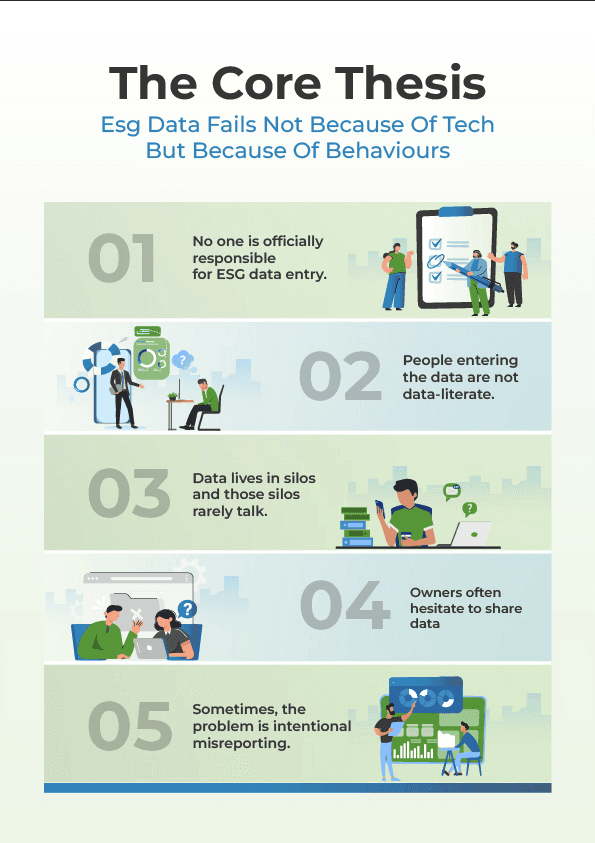

The Core Thesis: ESG Data Fails Not Because of Tech But Because of People

When ESG data breaks down, it’s rarely because the platform can’t handle inputs or the sensors don’t work. It breaks down because:

No one is officially responsible for ESG data entry: The role doesn’t exist, or it sits with someone who already has ten other priorities.

People entering the data are not data-literate: They don’t understand why the numbers matter or how they influence compliance, risk, or business continuity.

Data lives in silos and those silos rarely talk: Quality teams hold one piece, supply chain another, HR another. Everyone owns something, and no one owns the whole.

Owners often hesitate to share data because transparency can surface inefficiencies, non-compliance, or resource misuse.

Sometimes, the problem is intentional misreporting: From understated energy consumption to suppliers minimising quantities to reduce calculated emissions.

The result?

Even with the most advanced systems, ESG data becomes fragmented, delayed, incomplete, or untrustworthy not because technology failed, but because human behaviour did.

This is the invisible barrier that stops organisations from producing credible sustainability reports and limits the effectiveness of any ESG platform.

Barrier 1: “It’s No One’s Job” The Ownership Vacuum

Ask any company who owns ESG data, and you’ll hear the same answer: “It’s complicated.”

And that’s exactly the problem.

In most organizations:

There is no dedicated role for ESG data entry.

The compliance head is expected to “somehow bring it all together” even though they don’t own any of the raw data.

The people who do have the data (plant managers, procurement teams, HR, energy teams) do not see ESG as part of their core responsibilities.

ESG inputs are not included in KRAs, appraisals, or promotion criteria so there is no incentive, urgency, or accountability.

So ESG reporting becomes a last-minute scramble:

Data is stitched together from WhatsApp messages, emails, ad-hoc spreadsheets, and estimates.

Teams treat ESG as “extra work,” not as a business requirement.

The report gets compiled but the data behind it is weak, inconsistent, or unverifiable.

This ownership gap is the single biggest reason ESG data collapses before it even enters a system.

Until companies assign clear roles, KRAs, and accountability for ESG data entry and verification, even the best platform will feel like it’s running on empty.

Barrier 2: Low Data Literacy and No Understanding of the “Why”

Even when companies do assign someone to enter ESG data, a deeper issue emerges:

People don’t understand what the data means or why it matters.

Across factories, supply chains, and corporate teams, the reality is:

Many employees are not trained in data basics units, accuracy, conversions, activity-level metrics.

Teams often don’t know how ESG data links to:

Compliance risk

Buyer requirements

Export eligibility

Reputation

Cost of capital

So data entry becomes a mechanical chore, not a meaningful action.

This leads to predictable outcomes:

Wrong units (litres vs kilolitres, tonnes vs kilograms)

Estimates instead of measurements

Missing fields because “we never tracked this before”

Misaligned data across plants, suppliers, and divisions

Teams treating ESG inputs as “optional” instead of “critical”

And without context or training, people simply do not prioritise accuracy.

Here’s the uncomfortable truth: Most ESG errors are not technical errors, they're human misunderstandings.

Until organisations invest in data literacy, awareness, and purpose-sharing, ESG systems will continue to be fed poor-quality inputs.

Because people don’t produce good data until they understand why the data matters.

Barrier 3: Fragmented Ownership & Broken Stewardship

ESG data doesn’t live in one place it lives everywhere.

Energy sits with operations.

Safety sits with HR.

Waste sits with EHS.

Suppliers sit with procurement.

Diversity sits with HR.

Emissions sit across all of the above. This creates the biggest behavioural bottleneck of all:

Everyone owns a piece of the data but no one owns the whole.

What this leads to:

Data is scattered across divisions with no central accountability

Teams don’t coordinate on timelines, formats, or verification

ESG teams chase data across 8–12 departments every reporting cycle

Divisions hesitate to “let go” of data because it exposes inefficiencies

Sensitive metrics (energy waste, groundwater use, rejects) are often withheld or massaged

No single workflow ensures data moves from entry → validation → approval → reporting

And without stewardship, ESG reporting becomes a three-month scavenger hunt. The irony?

Companies expect high-quality reporting, but have no system that shepherds data into a single, verified barrel.

The result is predictable:

Incomplete reports

Delayed audits

Inconsistent facility comparisons

Disputes between functions

Data that the regulator, buyer, or auditor cannot trust

Unless organisations build clear ownership, structured workflows, and shared responsibility, ESG data will continue to slip through the cracks, no matter how advanced the platform is.

Barrier 4: Transparency Resistance & the Fear of Being Seen

Not all ESG data challenges come from ignorance or lack of process. Some come from something harder to fix:

People don’t want certain data to be visible.

And this is one of the most uncomfortable truths in sustainability reporting.

Inside large organisations, certain numbers when made transparent trigger scrutiny, escalations, or corrective actions. So instead of surfacing them honestly, teams:

delay data sharing

under-report usage

“smooth” numbers for internal comfort

avoid providing activity-level details

Why? Because transparent ESG data reveals:

Excessive energy consumption

Hidden groundwater extraction

High reject ratios

Unsafe contractor practices

Inefficient processes

Unreported waste streams

Supplier discrepancies

In short: data makes performance visible and visibility creates accountability. This generates behavioural resistance across many levels:

“If I share this number, my plant looks inefficient.”

“If we disclose groundwater use, we’ll get flagged.”

“If my supplier’s emissions spike, my category gets questioned.”

And at the supplier level, resistance can take a sharper form:

Data manipulation or misrepresentation.

Especially when suppliers want to:

show lower emissions

hide fossil-heavy inputs

inflate recycled content

understate waste

misreport quantities delivered

This isn’t always malicious, sometimes it’s fear-driven or simply due to lack of systems. But the outcome is the same:

Technology cannot fix what people intentionally hide.

Platforms can digitise, integrate, and validate but they cannot eliminate behavioural resistance to transparency.

Unless organisations address this fear, ESG data quality will always lag behind ESG ambition.

How Onlygood Breaks These Behavioural Barriers

Technology alone can’t solve behavioural problems.

But technology designed for human behaviour absolutely can.

At Onlygood, we’ve built our sustainability intelligence platform around one core principle:

Make doing the right thing the easiest thing.

Here’s how we remove the behavioural friction that stops ESG adoption:

1. Zero-friction data entry: We design experiences that make data entry intuitive not a chore. Clean UI, guided prompts, automated validations, and human-centred workflows ensure people don’t feel “burdened” by ESG tasks.

2. Hand-holding when needed: Where teams lack data literacy or clarity, we step in: walkthroughs, nudges, reminders, and contextual guidance help users understand why the data matters and how it impacts outcomes.

3. AI that fills the gaps: Our AI-powered ingestion handles what people avoid: OCR for bills, computer vision for non-structured invoices, auto-mapping for Excel sheets, and anomaly detection to catch errors and fraud.

4. IoT devices to eliminate manual entry altogether: Free sensors, meters, and integrations bring real-time data directly from the source — removing behavioural resistance by removing the need for human intervention.

5. Smart workflows that enforce stewardship: We create clear ownership paths: who enters, who verifies, who approves — all mapped through automated workflows so no data “falls through the cracks.”

6. Transparency that reduces data hoarding: Dashboards expose anomalies, inconsistencies, and missing data. When visibility is high, hiding information becomes harder and collaboration becomes easier.

7. Making ESG part of the system, not extra work: Our platform integrates into the user’s everyday environment, so ESG becomes part of the routine, not an additional task that gets deprioritised.

Conclusion: Sustainability Data Doesn’t Fail Because of Tech — It Fails Because of People.

Companies don’t struggle with ESG because the tools are weak. They struggle because:

ESG isn’t in anyone’s KRA

Data is scattered across teams

Ownership is ambiguous

People fear transparency

Manual work gets deprioritised

And sometimes… the data is deliberately “massaged”

These are behavioural barriers that are cultural, operational, human. And behavioural barriers cannot be fixed with software alone. They require platforms designed around people, not just regulations. They require systems that guide, nudge, automate, simplify and remove friction at every step.

That’s exactly what Onlygood is built for.

A sustainability intelligence layer that works with human behaviour, not against it. A system that makes ESG data complete, verified, continuous and regulator-ready.

Because when the behavioural blockers fall, everything else begins to flow: better compliance, cleaner disclosures, stronger governance, and true climate action.

If sustainability ambition is high but data remains the bottleneck…

It’s time to move to technology that solves for people.

Lets Talk…